South Florida Residential Real Estate Market Statistics - September 2022

To know more about new trends of the residential real estate market in September 2022 in five counties of South Florida (Miami-Dade, Broward, Palm Beach, Martin, St. Lucie), readers of the Vera Realty website will be prompted by Nick Polyushkin, an expert, licensed broker and head of the Vera Realty real estate company.

The traditional market overview in the segments of single-family homes, condominiums and townhouses is based on the reports of the Miami Association of Realtors for September 2022 in comparison with the data for September 2021 (https://www.miamirealtors.com/).

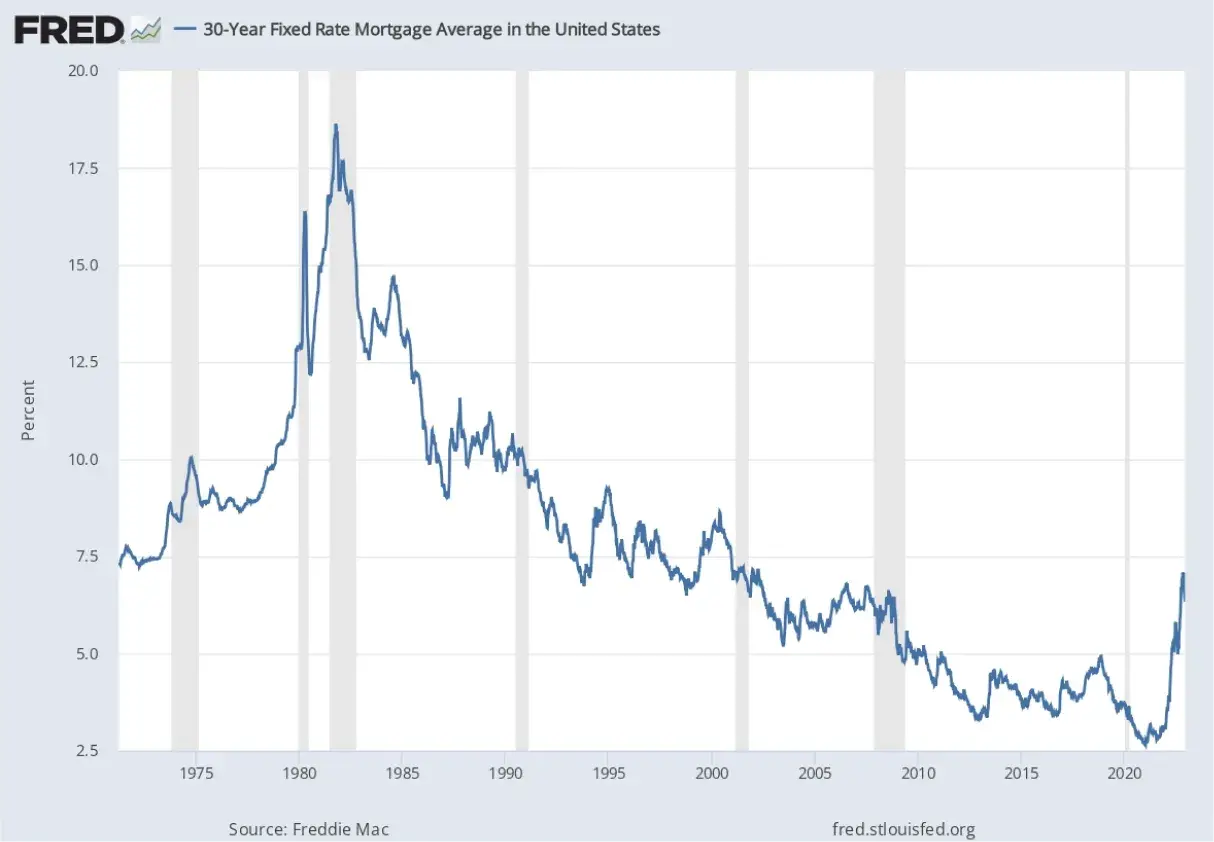

In statistical data analysis, we use database information provided by the research department of the Federal Reserve Bank of St. Louis (https://fredhelp.stlouisfed.org/fred/), concerning the key interest rate of the Federal Reserve System (FRS) and the associated most popular mortgage loan in the United States.

Housing market in South Florida in September 2022

Nick Polyushkin, an expert, licensed broker and head of the real estate company Vera Realty, explains to readers how the situation is developing in the real estate market of South Florida at the beginning of autumn 2022:

"In fact, the situation in the real estate market is quite predictable. In September 2022, the Florida real estate market continued to experience a combination of high demand, a gradual increase in the level of real estate inventories and changes in housing prices.

The US Federal Reserve System (FRS) raised the base interest rate by 75 basis points to the level of 3-3.25% per annum following the results of the September meeting, according to an official press release.

Since March, the Fed has been raising the rate for the sixth time — before that, it had been at almost zero since 2020. From zero rates in the long period, the rate increased to the level of 2008.

Diagram of database information provided by the research department of the Federal Reserve Bank of St. Louis (https://fredhelp.stlouisfed.org/fred/), According to the state mortgage corporation Freddie Mac, in September the average interest rate on a 30—year mortgage in the United States exceeded 6% - for the first time since the financial crisis of 2008.

It is clear that rapidly rising mortgage interest rates not only affect the number of home buyers on the market, which leads to a reduction in home sales, but also affect housing prices.

Fortunately, South Florida will still be one of the most attractive places in the country. Despite the rising interest rate, a critical slowdown in sales is unlikely to occur, since many transactions in Florida are still concluded without a mortgage.Miami’s percentage of sales continue to outpace of the nation, state.”

Statistics indicators of the residential real estate

market in South

Florida

1. Closed sales

In September 2022, in Miami-Dade County single-family home sales decreased to -30% year-over-year (August, 2022: -21.2 %), due to lack of inventory and rising mortgage rates, as well as Miami-Dade existing townhouses and condominiums sales decreased -26.9% year-over-year (August, 2022: - 26 %).

In Broward County, closed sales for single-family homes continued to decline to -30% (August, 2022: - 26 %), and for townhouses and condos the decline was -20% (August, 2022: - 16.6 %).

In Palm Beach County, closed sales for single-family homes were down -19% (August, 2022: -20.4%), and for townhouses and condos they were -32% (August, 2022: -29.7%).

In Martin County, closed sales for single-family homes decreased to -15% (August, 2022: -17.6%), the decline for townhouses and condominiums was -28% (August, 2022:-15.1%).

In St. Lucie, this indicator for single-family homes increased in a negative value to -18% (August, 2022: -5.3%) compared to September 2021; and for townhouses and condominiums, it changed to -11% (August 2022: -28.3%).

September 2022 for five counties of South Florida is characterized by a decrease in closed sales of the number of single-family homes to -22.4%, and for townhouses and condominiums - to -23.4% compared to September 2021. If we collate the indicators of September and August 2022, the decline in indicators for single-family homes continued, while the indicators of townhouses and condominiums have not changed.

| Some counties of South Florida | Single-family homes | Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach,

Martin, St.Lucie |

-22.4% | -23.4% |

Table1.The average value of the ‘closed sales’ indicator in Miami-Dade, Broward, Palm Beach, Martin, St.Lucie counties in September 2022 in comparison to September 2021

2. Paid in cash

Cash sales in Miami in September 2022 exceeded the national figure. According to the latest NAR statistics, about 22% of home sales in the US are carried out in cash. Cash sales accounted for 39.5% of sales closed in Miami in September 2022, up from 37.3% in September 2021. The high percentage of cash buyers reflects Miami's leading position as an outstanding US real estate market for foreign buyers who tend to make purchases for cash, as well as some moving from more expensive US markets who can buy more with their profits from the sale of real estate.

In September 2022, сash payments for the purchase of single-family homes in Miami-Dade County were down to -2.5% (August, 2022: +12.2% ). For townhouses and condominiums in the same area, this indicator changed again to +7.3% (August, 2022: -0.8% ).

In Broward County, cash payments for single-family homes increased to +10.5% (August, 2022: +3.6%), and for townhouses and condominiums changed from +5.1% (August, 2022) to -2.3% (September, 2022).

In Palm Beach County, the prices in cash for single-family homes were at the point +7% (August, 2022: +1% ), but for townhouses and condominiums the indicator was at the point -1.3% (August, 2022: +0.8%).

In Martin County, changes in this indicator for single-family homes were from -2.2% (August, 2022) to -0.2% (September, 2022), and for townhouses and condominiums from -14.9% (August, 2022) to - 9% (September, 2022).

In St. Lucie, the change in payment for single-family homes was from -18.1% (August, 2022) to +4.7% (September, 2022), and for townhouses and condominiums from -37.6% (August, 2022) to +10.5% (August, 2022).

The average statistics of the ‘paid in cash’ indicator for five counties under consideration in September 2022 compared to September 2021 is as follows: for single-family homes it changed from -0.7% (August, 2022) to +3.9% (September, 2022), and for townhouses and condominiums the indicator increased from -9.46% (August, 2022) to +1.04% (September, 2022).

| Some counties of South Florida | Single-family homes | Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach,

Martin, St.Lucie |

+3.9% | +1.04% |

Table2.The average value of the ‘paid in cash’ indicator in Miami-Dade, Broward, Palm Beach, Martin, St. Lucie counties in September 2022 in comparison to September 2021

3. Median sale price

Housing prices are still affected by the supply of inventory. In Martin and St. Lucie counties, some price declines can be observed.

In Miami-Dade County, the median sale price of single-family homes increased to +17.1% compared to the previous September 2021, and as for townhouses and condominiums, this figure also increased to +19.7%.

In Broward County, the median sale price of single-family homes remained unchanged +13.1%, and for townhouses and condominiums it increased from +20.6% to +24.4% compared to the previous month (August,2022).

In Palm Beach County, the median prices for single-family homes continue to grow by +23.43% (August 2022: +17.7%), while prices for townhouses and condominiums decreased to +17.6% (August 2022:+25.4%).

In Martin County, single-family home prices fell to +21.1% (August 2022: +33.3%), while townhouses and condominiums also fell to +26.5% (August 2022: +47.6%).

In St. Lucie, the indicator for single-family homes decreased to +19% (August 2022: +22.7%), and for townhouses and condominiums it also decreased to +11.3% (August 2022: +27.9%).

In September 2022, in 5 counties of South Florida, the average values for single-family homes decreased from +19.48% (August 2022) to +18.7% (September 2022), compared to the previous year, and for townhouses and condominiums they also decreased from +26.68% (August 2022) to +19.9% (September 2022).

| Some counties of South Florida | Single-family homes | Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach,

Martin, St.Lucie |

+18.7% | +19.9% |

Table3.The average value of the ‘median sale price’ indicator in Miami-Dade, Broward, Palm Beach, Martin, St.Lucie counties in September 2022 in comparison to September 2021

4. Median percent of original list price received

In September 2022, in all five counties, the ‘median percent of original list price received’ indicator for single-family homes was -2.6% year-over-year, and for townhouses and condominiums, it was -1.18%. As for the comparison with August 2022, it is needless to say that the indicator has decreased.

| Some counties of South Florida | Single-family homes | Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach,

Martin, St.Lucie |

-2.6% | -1.18% |

Table4.The average value of the ‘median percent of original list price received’ indicator in Miami-Dade, Broward, Palm Beach, Martin, St. Lucie counties in September 2022 in comparison to September 2021

5. Median time to contract

In Miami-Dade County, for the segment 'single-family homes' this indicator was +33.3% year-over-year, and for ‘townhouses and condominiums’, it was down -20%. The median number of days between listing and contract dates for Miami single-family home sales was 24 days, up from 18 days last year. The median number of days between the listing date and contract date for condos was 28 days, down 20% from 35 days.

In Broward County, the index for single-family homes increased by +69.2% year-over-year, and for townhouses and condominiums it was -5.3%.

In Palm Beach County, the median time to make a contract for the purchase of single-family homes was +57.14%, and for townhouses and condominiums +17.6%.

In Martin County, the change in the indicator for single-family homes was +6.3%, and for townhouses and condominiums the indicator was +50%.

In St. Lucie, the increase in median contract time for single-family homes was +144.4%, and for townhouses and condominiums - +133.3%.

In September 2022, there is an increase in the indicator of ‘median time to contract’ for single-family homes to +62.06% in almost all five counties, compared to September 2021. For townhouses and condominiums, the indicator value changed by +35.12%.

| Some counties of South Florida | Single-family homes | Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach,

Martin, St.Lucie |

+62.06% | +35.12% |

Table5.The average value of the ‘median time to contract’ indicator in Miami-Dade, Broward, Palm Beach, Martin, St.Lucie counties in September 2022 in comparison to September 2021

6. Median time to sale

In September 2022, in five counties under consideration, the ‘median time to sale’ indicator for single-family homes changed from +32.17% (August, 2022) to +13.06% (September, 2022), compared to September 2021, and for townhouses and condominiums - from -2.56% (August, 2022) to +3.04% (September, 2022).

As an example, let's give the change in the indicator in Miami.The median time for Miami single-family homes sales was 68 days, a 3% increase from 66 days last year. The median number of days for Miami condos sales was 71 days, a 13.4% decrease from 82 days.

In September 2022, real estate transactions took from 54 to 71 days, depending on the types of real estate and the area itself.

| Some counties of South Florida | Single-family homes | Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach,

Martin, St.Lucie |

+13.06% | +3.04% |

Table6.The average value of the ‘median time to sale’ indicator in Miami-Dade, Broward, Palm Beach, Martin, St. Lucie counties in September 2022 in comparison to September 2021

7. Inventory/active lists

According to the statistics, the general trend of the real estate market in September 2022 is the growth of new offers in all five counties.

In Miami-Dade County, inventory of single-family homes increased to +32.3% year-over-year (September 2022) from 2,957 active listings last year to 3,912 last month. Condominium inventory dropped - 20.5% year-over-year to 6,399 from 8,049 listings during the same period in 2021. In August 2022, for townhouses and condominiums, this figure was -23.8%.

In Broward County, the rate of inventory for single-family homes increased from +46.7% (August, 2022) to +52% (September, 2022), and for townhouses and condos from -7% (August,2022) to -2.4% (September, 2022).

In Palm Beach County, the index of active inventory for single-family homes changed up from +63.15% (August, 2022) to +67.81% (September, 2022), and for townhouses and condos it increased from +28.3% (August, 2022) to +38.1% (September, 2022). Single-family housing inventory has increased for the fourth straight month in Palm Beach County.

In Martin County, the growth of the indicator for single-family homes was from +62.3% (August, 2022) to +67.6% (September, 2022), and for townhouses and condos it changed from +56.3% (August, 2022) to +85.5% (September, 2022).

In St. Lucie, an ongoing growth for single-family homes from +124.4% (August, 2022) to +131.2% (September, 2022), while the changes for townhouses and condos were from +31% (August, 2022) to +37.1% (September, 2022).

The September increase in active listings for the five counties was +70.1% compared to September 2021, and for townhouses and condominiums, the change was +27.5%.

| Some counties of South Florida | Single-family homes | Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach,

Martin, St.Lucie |

+70.1% | +27.5% |

Table7.The average value of the ‘inventory/active lists’ indicator in Miami-Dade, Broward, Palm Beach, Martin, St. Lucie counties in September 2022 in comparison to September 2021

8. Months supply of inventory

In September 2022, the months supply of inventory continues to increase to 3 months.

In Miami-Dade, months' supply of inventory for single-family homes increased to +59.1% (3.5 months) year-over-year, which indicates a seller's market. Inventory for existing condominiums decreased to +18.6% (3.5 months), which also indicates a seller's market. A balanced market between buyers and sellers offers between six- and nine-months supply.

In Broward County, the monthly inventory supply for single-family homes was up to +80% ( 2,7 months), for for townhouses and condos , the indicator was +10%.

In Palm Beach County, the monthly inventory supply index for single-family homes continued to grow from +92.9% (August, 2022) to +107.1% (2.9 months), and for townhouses and condominiums it changed from +40% (August, 2022) to +57.1% in September 2022.

In Martin County, the indicator for single-family homes was +125.0% (2.7 months), and for townhouses and condominiums it has already grown to +130.0%.

In St. Lucie, the inventory supply for single-family homes continues to grow from +125% (August, 2022) to +133.3% (2.8 months) in September 2022; and for townhouses and condominiums, changes have occurred from +75% (August, 2022) to +83.3% in September 2022.

| Some counties of South Florida | Single-family homes | Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach,

Martin, St.Lucie |

+100.9% | +52.36% |

Table8.The average value of the ‘months supply of inventory’ indicator in Miami-Dade, Broward, Palm Beach, Martin, St.Lucie counties in September 2022 in comparison to September 2021

The demand for real estate in Florida has been extremely high over the past few years. Since interest rates have increased many times since the beginning of 2022, we now see that the number of single-family homes (measured in months) is starting to grow from historical lows.The average price of housing in Florida at the end of September 2022 is now 407 thousand dollars, and this represents an increase of 27.8% compared to the same period last year.

Ultimately, there is always an opportunity to make a profitable purchase in the real estate market. You just need to thoroughly research this market. If you want to calculate the cost of a mortgage, we invite you to use the mortgage calculator posted on the Vera Realty website.