South Florida Real Estate Market

Overview

(2019-2022)

Over the past few years, the number of people, wishing to move to South Florida for permanent residence, has increased. Why is this happening? What has always been attractive for buyers of real estate in this region? What began to change in the South Florida Real Estate Market in the pandemic and post-pandemic period from 2019 to 2022?

The review covers the main trends in the residential real estate market in South Florida in the pre- and post-COVID crisis period (2019-2022).

An inside vision of the real estate market (depending on the area and the object), an operational analysis of the current trends, the choice of the right time to complete the transaction, insights regarding shortterm and long-term rental of residential properties is a service provided by the community of companies - Vera Realty (Miami Real Estate Company), Vera Fund (Florida Investment Company) with the cooperation оf Big Data Realty (Miami Analytics Company).

It is known that the Florida real estate market is one of the most active in the United States.

There are many reasons for buyers, sellers, and investors to be interested in the Florida real estate market: affordable home prices, availability of lots of undeveloped lands in the state, high inventory in the real estate market, low mortgage rates, various financial state incentives, several state tax benefits to residents and investors, ready rental market, long-term economic growth and stability, strong job market, growing population, unique lifestyle.

Historically, some residents of the northern US states, for example, from New York, Philadelphia, and a number of American cities, have always had second homes or vacation houses in South Florida, coming here to have a rest.

Beautiful beaches, picturesque places, a warm climate, plenty of sun, rapidly developing cities with a full service of resort entertainment and an appearing convenient infrastructure were before and are providing a constant flow of vacationers and tourists to South Florida.

If in 2018 in South Florida there was a decline in real estate prices by 10%-15%, depending on the object and area, then by 2019 housing prices have stabilized.

In South Florida, there has always been a principle of analyzing the trends of recent real estate sales in the area. This gave an idea of what housing prices would be in the near future in this area.

Traditionally, when buying a house in South Florida, the price could be reduced by about 10% of the asking price.

It was accepted, when home sellers deliberately put their houses on the market for more than they expected. That was why as with all negotiations, homebuyers, making an offer on a house, gave 10% lower than the asking price, especially if their real estate agents had strong negotiation skills.

The common procedure of house purchase was to conduct an inspection to find any shortcomings for an additional reduction in the price of a residential object. Inspections and appraisals are always an opportunity for better evaluation of the home's condition and value before officially purchasing it.

As usual closing costs are divided among the buyer and seller. The seller typically paid 5% - 10% of the sale price, while the buyer in Florida — 3% - 5% as closing costs. The average real estate agent commission in Florida was around 5-7% of the home’s price.

At the beginning of the pandemic, for some time there was a misunderstanding of the current situation in the residential real estate market in the United States.

The general uncertainty of the events related to the pandemic affected the fact that in the first half of 2020, the number of residential properties for sale in Florida decreased sharply, and there was a housing inventory shortage.

In South Florida, real estate prices have fallen. For about three months from the beginning of the year, banks began to suspend lending for residential real estate at the contracting stage. Transactions were either frozen or canceled. At the same time, in order not to lose money and get out of the transaction, special additions to the agreements (an addendum) were being used.

That said, by the end of the first half of 2020, when people began to adapt to quarantine restrictions, sales of apartments and condos increased by approximately 30%. Condo and apartment buildings tend to be structured similarly - they often come with comparable amenities. The closure of access to public areas (swimming pools, spas, fitness complexes, bars, restaurants, cafes, etc.), which are typically located inside housing complexes and represented increased amenities for residents, influenced the need to search for housing with a larger area and the possibility of remote work.The residential real estate market was dominated by cash transactions.

Naturally, at the end of the first half of 2020 (Q1 and Q2), the first wave of migration of residents from New York and northern states to South Florida began, where the restrictive conditions for COVID-19 were not harsh, in comparison to other regions of the United States. Restaurants worked "to take away". It was possible to go outside without limitation of movement, walk to the ocean.

The general tendency of active migration to the south in the first wave is the relocation of US residents who already have their own housing (second homes and vacation houses) in South Florida. According to various expert data for 2020, about 250,000 people moved from New York to South Florida, and this figure is constantly growing.

The trend of the market in the second half of 2020 (Q3-Q4) is the relocation to a permanent place of residence in South Florida of those people who did not own real estate here, but often went here on vacation, and rented apartments during the holidays. The ability to work from anywhere reinforced this trend. Americans started buying bigger homes when the pandemic started, as people were looking for more space for remote work, home schooling and social distancing. It was the beginning of the second wave of migration to South Florida.

By the second half of 2020, the South Florida residential real estate market began to revive and gradually recover. Due to the transition to remote work and the arrival of new residents from other states (especially from the cities of New York, Philadelphia, Boston, Chicago etc.), as well as foreign immigrants, a natural demand for ready-to-live facilities began to arise. And although at the second half of 2020 it was still possible to find good pre-pandemic offers for residential real estate in Florida, by the end of 2020 the price growth was about 10-15%.

By the end of 2020, it became clear that insufficient offering in the residential real estate market is fueling the hype.

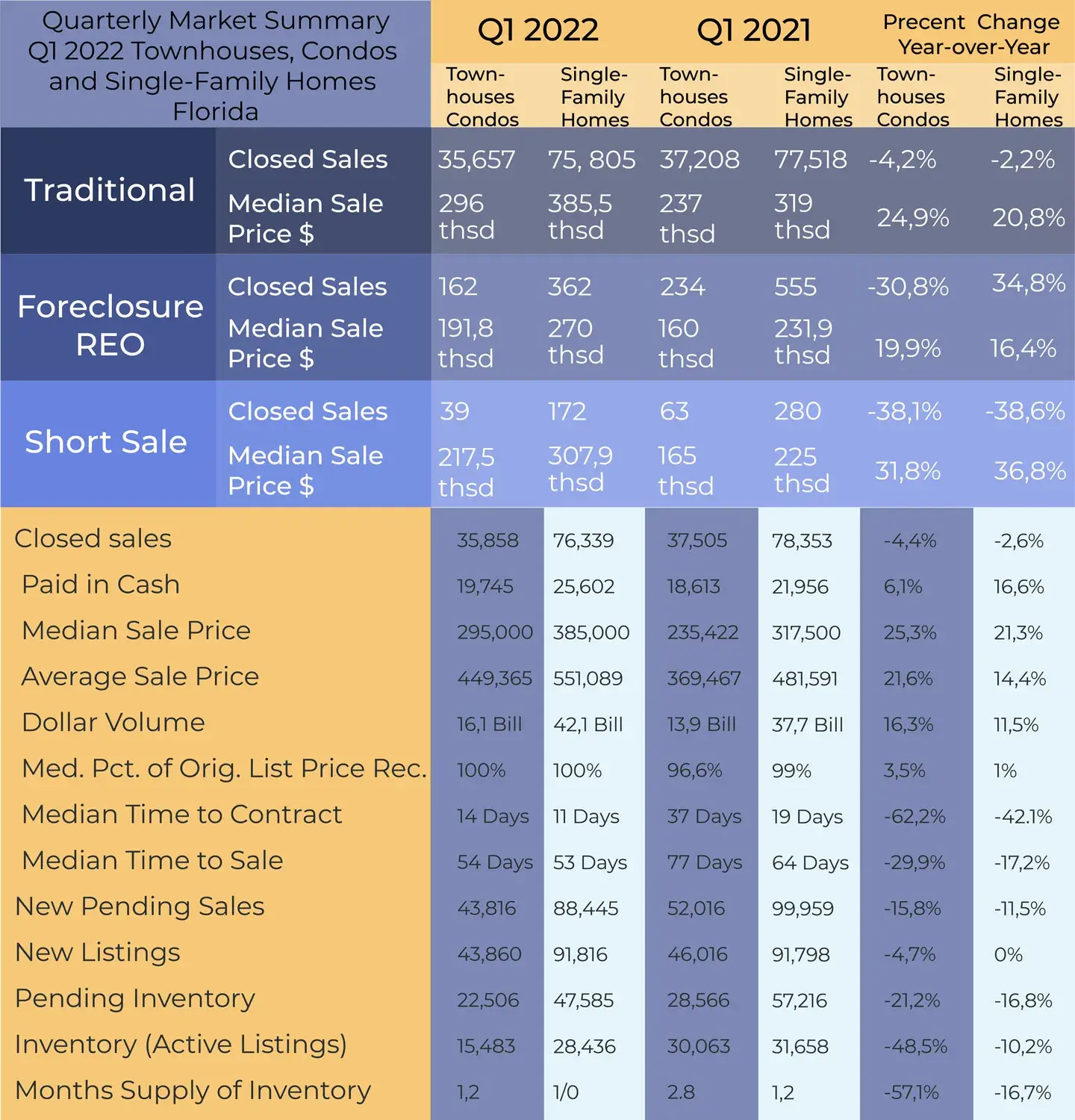

What was happening in the South Florida residential real estate market in 2021?

In the first half of 2021, there was a sharp rise in prices of residential real estate due to a perceived shortage of residential objects, as new immigrants, who had already arrived, increased the number of South Florida residents in need of housing.

During the pandemic period of 2021, homeowners were in no hurry to be active in selling houses, looking for a better overall house value, and at the same time the situation prevented builders from building new housing.

Developers, who withstood the pandemic pause, did not have time to meet the new construction schedules.

Of course, the preferences of recent homebuyers in South Florida were in purchasing a ready-to-live housing in order to avoid additional financial investments in updating individual design features, repairs and problems with plumbing or electricity.

Detached single-family homes continued to be the most common home type for 80% of homebuyers. Another popular type of housing among homebuyers was townhouses.

Since South Florida's home prices have risen significantly in 2021, buyers have often had to buy their homes for 100 percent of the asking price.

In the real estate market, the so-called "bidding wars" have begun - games to increase prices. Before the COVID restrictions, the asking prices were getting off till 10%, now asking prices have begun to increase from 10% and more over. The average growth in the price of residential real estate over the past year was 10-20%, although in some areas it reached 40% or more. The average cost of a detached house was $ 500,000- $550,000, whereas 2-3 years earlier similar objects were sold for $ 300,000.

In general, according to the results of the "pandemic year" 2021, we can state an excess of demand for residential real estate in South Florida, especially in the segment of waterfront houses, single-family houses, and townhouses.

The price of the popular housing with convenient infrastructure (supermarket systems, restaurants, schools, hospitals, entertainment centers, sports facilities, etc.) increased in South Florida ranged from 25% to 100%.

These areas with prestigious luxury waterfront houses, townhouses, houses on golf courses, and other private houses are located in the neighborhood of Hollywood (Free Islands, Florida), Hallandale, Sunny Isles, Eastern Shores, Bal Harbour, Miami Beach, Star Island, Las Oas (Fort-Lauderdale), Coral Ridge. In new residential districts in Boca Raton, where the permanent developer is building individual houses, the price growth for real estate is about 100%.

During "the record sales year" of 2021, customers' preferences have changed. Young families had a need to broaden their living space, elderly owners were in no hurry to leave their private homes for condominiums, the flow of foreign buyers increased, and the percentage of citizens willing to invest in real estate enlarged.

In the post-COVID period of the end of 2020 and the whole of 2021, mortgage lending rates for the population fell to a historic low of 1.8%-2.5%. There were people who were pushed by low rates to purchase more profitable housing. These cases were typical not only in Florida, but all over the states. The millennial generation, which had previously saved money and did not dare to buy real estate, became active in decision-making.

To sum up, the whole of 2021, its trends are an active second wave of migration to South Florida, the real estate price growth, an increase in inflation to 8%, a change in the way of buying a house and the process of price formation for a house.

What to expect from the South Florida residential real estate market in 2022?

For making an educated guess about the future directions of the South Florida real estate market in 2022 and using the information for the successful work of Vera Realty with clients it is necessary to pay attention to official analytics and historical data.

Regardless of the politics and infection of COVID-19, South Florida real estate is still one of the most desirable locations to live and invest.

According to some analysts' point of view, by 2022, the government, in whose hands the market control lever is, will artificially slow down the price growth.

But the hype around housing demand has influenced analytical forecasts about the rise in mortgage lending rates to 4% and above by 2022. At the beginning of 2022, rates were still at the same level, but by the second quarter they had risen to 5-6%.

At a recent real estate conference in Las Vegas, it was noted that in 2022 there would be expected a slowdown in the pace of sales, the number of inventory on the real estate market would increase, respectively, the price of housing would change downward by 5-7%.

As for real estate investments, in the post-pandemic period, some large companies began to move their corporate headquarters to the main locations of South Florida (Miami-Dade, Broward and Palm Beach counties; the cities of Miami, Fort Lauderdale, West Palm Beach) due to the tax benefits available there.

It is worth noting, South Florida is a very attractive state for business, since there is no income tax here. In addition, the level of wages has always been lower than in New York, Chicago, Boston, since historically it was believed that life here is cheaper, and, accordingly, real estate is cheaper too.

However, median home values in the South Florida real estate market as well as rent continue to grow. Concerning immigrants from northern states whose wages remained quite high, local residents' wages have not changed, which certainly creates a problem for local people who cannot afford to buy and rent real estate at a price higher than what the immigrants - homebuyers can afford.

At the moment, individual houses for sale get a lot of offers, and sellers raise their prices accordingly. It means that existing housing inventory in South Florida was not available to all buyers. As a consequence, homebuyers have started purchasing smaller homes than they were at the height of the pandemic. In many areas around the US, including South Florida, condo sales are also starting to rebound.

At the moment, individual houses for sale get a lot of offers, and sellers raise their prices accordingly. It means that existing housing inventory in South Florida was not available to all buyers. As a consequence, homebuyers have started purchasing smaller homes than they were at the height of the pandemic. In many areas around the US, including South Florida, condo sales are also starting to rebound.

Most likely, the price-to-rent ratio in the state will lead to more people becoming renters; houses are too expensive for many to even consider buying. The lack of housing affordability, forcing people to rent it out, will increase demand, and landlords will be able to increase the requested rates and reduce the risk of vacancies.

It can be assumed that the expected stabilization in 2022 of residential real estate price growth will create a favorable situation of sufficient stability and attractiveness of the South Florida residential real estate market for all categories of consumers - buyers, sellers, investors.

Next overview will provide greater insight into how home buyers and sellers are adjusting to these new realities in specific areas of South Florida.