South Florida Residential Real Estate Market Statistics May 2022

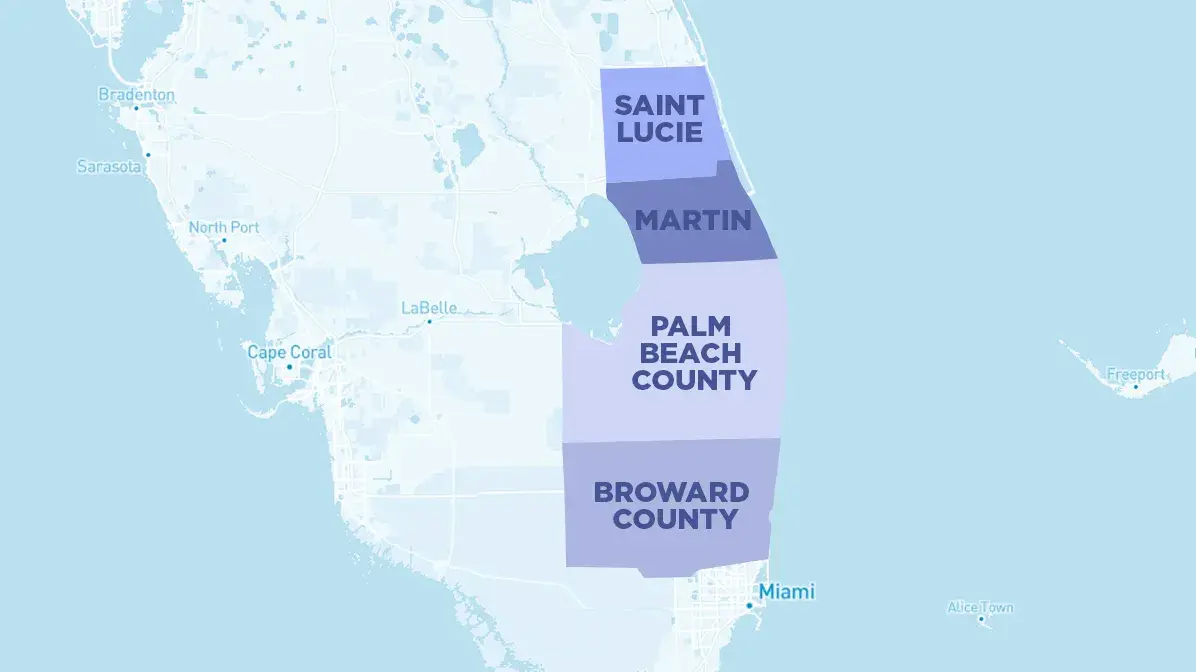

The review of the residential real estate market in South Florida for May 2022, made by Nick Polyushkin, an expert, licensed broker and head of the real estate company Vera Realty, covers those areas in which Vera Realty team is engaged in the predominant part of its business. These are the following counties of South Florida: Miami-Dade, Broward, Palm Beach, Martin, St. Lucie. Let's see what happened to the housing market in May 2022 in the counties indicated above. As always, we will touch on changes in the real estate market in the segments of single-family homes, condominiums and townhouses.

Changes in the housing

market: inflation, rising

housing interest rates

2022

As N.POLYUSHKIN considers: "In real estate, you have to constantly be in a good shape, adapt to circumstances. Sometimes it just doesn't work out to go down "the smooth road''. Thinking over the statistical data of the indicators, we have to predict what to do at the moment."

Talking about the company's sales success over the past two years as a result of a record low interest rate, Nick emphasizes that now "аn increase in inflation, a slowdown in the US economy, an increase in the mortgage rate to 5% and more - problems that investors and buyers have to face."

According to forecasts of a number of analysts, this situation is unlikely to affect an early and significant decline in housing prices. Most likely, the growth rate of real estate prices will gradually slow down.

"There is a general trend towards an increase in sales of apartments in condominiums, as COVID restrictions are lifted, access to equipped common areas and amenities is returned. In addition, the affordability of such housing for the buyer looks attractive."

Analyzing the statistics in South Florida, Nick notices that in May 2022 there is a buyer's demand for renting in condos.

"Most likely," - notes Nick Polyushkin, - "the number of inventory in the segment of "single-family homes" will increase, as the cost of such houses increases along with inflation."

But if you still decide not to postpone the purchase of a house and if its price still fits into your budget, determine it as a strategy with an experienced agent!

As always, we will analyze the statistics on the main indicators offered in the reports of the Miami Realtors Association (https://www.miamirealtors.com/).

Some statistics according the residential real estate market indicators in South Florida

In this review, especially for readers, we remind you what the main indicators of the real estate market mean.

Closed sales

The stat shows the number of completed transactions during the month.

In May 2022 closed (completed) sales for single-family homes in Miami-Dade County decreased by -12.3 %, compared to the previous May 2021. In the same county for townhouses and condominiums there was a decrease of -7.9%. In Broward County, a similar decrease was observed to be at rate -12.4%, and for townhouses and condos by -13.5%. In Palm Beach County, the rates of closed sales for single-family homes were -19.21%, and for townhouses and condos -24,3%. In Martin County, a decrease for single-family homes was -20.9%, and for townhouses and condos -19.9%. In St. Lucie, the figure for single-family homes increased by +2.3% and decreased for townhouses and condominiums by -34.7%.

On average, in May 2022 in all five districts transactions for single-family homes decreased by -12.5% compared to May 2021, and for townhouses and condos by -20.6%. As for "single-family houses" in St. Lucie, there was no decrease in the number of closed transactions.

| Some counties of South Florida |

Single-family homes |

Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach, Martin, St.Lucie |

-12.5% | -20.6% |

Table1.The average value of the indicator "closed sales" in Miami-Dade, Broward, Palm Beach, Martin, St.Lucie counties in May 2022 in comparison to May 2021

Paid in cash

The parameter demonstrates the number of completed closed transactions paid in cash.

In May 2022 сash payments for the purchase of single-family homes in Miami-Dade County were up by +26.9% compared to the previous May 2021. For townhouses and condominiums in the same county this indicator climbed to +8.5%. In Broward County, there was a +31.5% increase in cash payments for single-family homes, and a +16% increase for townhouses and condos. In Palm Beach County, rates of this indicator for single-family homes jumped to +11.2%, and for townhouses and condos to +6.5%. In Martin County, an increase f or single-family homes is by +3.5%, and, on the contrary, there was a decrease for townhouses and condos by -3.4%. In St. Lucie, an increase for single-family homes amounted +3.7%, and for townhouses and condos was +11.6%.

On average, in May 2022 in five counties "paid in cash" for single-family homes increased by +15.36% compared to this period in 2021, and by +7.84% for townhouses and condos in that period. As for cash transactions, this parameter has increased in all four counties, with the exception of Martin County in the segment "condominiums and townhouses".

| Some counties of South Florida |

Single-family homes |

Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach, Martin, St.Lucie |

+15.36% | +7.84% |

Table 2.The average value of the indicator "paid in cash" in Miami-Dade, Broward, Palm Beach, Martin, St. Lucie counties in May 2022 in comparison to May 2021

Median sale price

The median sale price is an average sale price of close selected objects.

In May 2022 the median prices continued to skyrocket in Miami-Dade, Broward, Palm Beach, Martin, St. Lucie counties according to reports from the Miami Association of Realtors.

To sum up, in May 2022 in these five counties of South Florida prices for single-family homes increased by +20.73% compared to May 2021, and for townhouses and condos - by +24.5%.

| Some counties of South Florida |

Single-family homes |

Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach, Martin, St.Lucie |

+20.73% | +24.5% |

Table 3.The average value of the indicator "median sale price" in Miami-Dade, Broward, Palm Beach, Martin, St.Lucie

Median percent of original list price received

This is an indicator of the median percent of original list price received for the sold object.

Approximately, in May 2022 in all five counties, the median percentage of the initial declared price for single-family homes increased by the figure +0.8% compared to May 2021, and for townhouses and condos by +2.52%.

| Some counties of South Florida |

Single-family homes |

Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach, Martin, St.Lucie |

+0.8% | +2.52% |

Table 4.The average value of the indicator "median percent of original list price received" in Miami-Dade, Broward, Palm Beach, Martin, St. Lucie counties in May 2022 in comparison to May 2021

Median time to contract

It means the median number of days between the listing date and contract date for all Closed Sales during the month.

In May 2022 in Miami-Dade County, for single-family homes there was a decrease of -22.2% compared to the previous May 2021. For townhouses and condominiums, a decrease of -57.1%. In Broward County during this period there was a decrease in prices for single-family homes with an indicator of -8.3%, and for townhouses and condominiums -57.6%. In Palm Beach County, the median time to contract for single-family homes was 0%, and for townhouses and condos -54.5%. In Martin County, a decrease for single-family homes was -8.3%, and for townhouses and condos - 0%. In St. Lucie, on the contrary, an increase for single-family homes was%, and a decrease for townhouses and condos was -18.2%.

In summary, in May 2022 in five counties, the indicator in question for single-family homes decreased by -9.98% compared to May 2021, and for townhouses and condos by -37.48%.

| Some counties of South Florida |

Single-family homes |

Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach, Martin, St.Lucie |

-9.98% | -37.48% |

Table 5.The average value of the indicator "median time to contract" in Miami-Dade, Broward, Palm Beach, Martin, St.Lucie counties in May 2022 in comparison to May 2021

Median time to sale

It is about the median number of days after an offer is accepted and before the housing is officially sold.

In general, in May 2022 in five considered counties for single-family homes a decrease amounted to -10.99% compared to May 2021, and for townhouses and condos to -20.98%.

There is a clear tendency to increase the speed of the market reaction to the processing of documents related to the time of conclusion of the contract and the full completion of the sale of real estate, which means that the time for these operations is reduced. As soon as property is listed it is coming off the market. Median time to contract is very short: for condominiums in some districts (Martin, St.Lucie), only 9 -10 days. Аnd median time to sale for condos drops to 46-47 days. As for customer preferences, cash transactions, when buyers are not related to mortgages, have begun to increase significantly.

| Some counties of South Florida |

Single-family homes |

Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach, Martin, St.Lucie |

-10.99% | -20.98% |

Table 6.The average value of the indicator "median time to sale " in Miami-Dade, Broward, Palm Beach, Martin, St. Lucie counties in May 2022 in comparison to May 2021

Inventory/active lists

Here we are speaking about the number of active real estate listings at the end of the month.

In May 2022, in Miami-Dade County, the number of inventory in active lists for single-family homes was up to +0.2% compared to the previous May 2021. For townhouses and condominiums it was down to -43.8%. In Broward County, the rate of inventory for single-family homes was +4.6%, and for townhouses and condos it decreased to -40.5%. In Palm Beach County, the index of active inventory for single-family homes was up to +23.06%, and for townhouses and condos it was down to -20.5%. In Martin County, an increase for single-family homes was observed to be up +23.6%, and for townhouses and condos was +6.2%. In St. Lucie, an increase for single-family homes by +37.7%, and a decrease for townhouses and condos was -0.6%.

In May 2022, the total increase in active inventory for the five counties was +17.87% compared to May 2021, and for townhouses and condos a decrease - by -19.84%. If we observed a noticeable increase in active inventory for "single-family houses", then for "townhouses and condos" there is a clear decrease.

| Some counties of South Florida |

Single-family homes |

Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach, Martin, St.Lucie |

+17.87% | -19.84% |

Table 7.The average value of the indicator "inventory/active lists" in Miami-Dade, Broward, Palm Beach, Martin, St. Lucie counties in May 2022 in comparison to May 2021

Months supply of inventory

This is a number of months it will take to deplete current inventory, given the latest sales rates.

In May 2022, the month's supply of inventory for single-family homes in Miami-Dade County was at the 0% level, compared to the previous May 2021. For townhouses and condominiums, a decrease was -58.3%. In Broward County, the figure of monthly inventory supply for single-family homes increased by + 7.1%, and for townhouses and condos it came down to -48.1%. In Palm Beach County, the monthly inventory supply index for single-family homes was +30%, and for townhouses and condos +27.8%. In Martin County, the numbers for single-family homes jumped to +54.5%, and for townhouses and condos to +18.2%. In St. Lucie, an increase for single-family homes was +30%, and for townhouses and condos was +16.7%.

| Some counties of South Florida |

Single-family homes |

Townhouses and condos |

|---|---|---|

| Miami-Dade, Broward, Palm Beach, Martin, St.Lucie |

+24.32% | +33.82% |

Table 8.The average value of the indicator "month's supply of inventory" in Miami-Dade, Broward, Palm Beach, Martin, St.Lucie counties in May 2022 in comparison to May 2021

Vera Realty expert Nick Polyushkin highlighted that the benchmark for a normal balanced market for buyers and sellers is 6 months of inventory. If the indicator is higher, it is traditionally a buyer's market, if it is lower - a seller's market. Now in five described districts, the reserve of inventory is designed for only 2 months.

Nick's opinion about falling homebuyers activity: "There will always be those who do not want to put their lives on "pause" because of rising real estate prices. The advice for everyone is to analyze the information!"

This review contains data from the Miami Association of Realtors for May 2022.